About Car Sales Tax Calculator

A Car Sales Tax Calculator is an online tool designed to help you calculate the sales tax you’ll need to pay when purchasing a vehicle, either new or used.

How to Use

Using our Car Sales Tax Calculator is simple. Follow these steps:

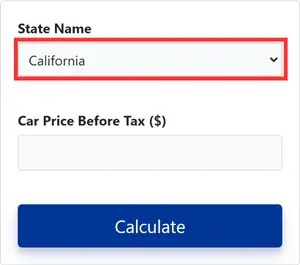

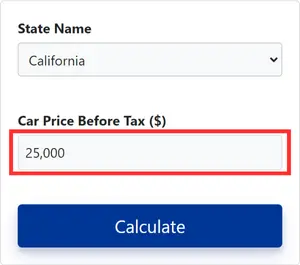

1. Select Your State – From the dropdown menu, choose the state where you are purchasing the vehicle. If you're buying out-of-state, select the state of purchase. 2. Enter the Car Price – Type the car price (before tax) into the input

box. The tool automatically formats the number with commas for readability.

2. Enter the Car Price – Type the car price (before tax) into the input

box. The tool automatically formats the number with commas for readability.

3. Click on ‘Calculate’ – After entering the car price and

state, click the "Calculate" button.

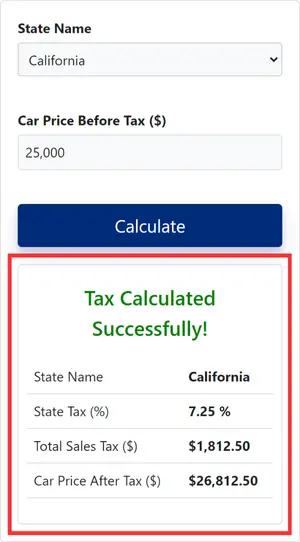

4. View Results – The tool will display:

3. Click on ‘Calculate’ – After entering the car price and

state, click the "Calculate" button.

4. View Results – The tool will display:

- State Name: The selected state.

- State Tax Percentage: The sales tax percentage applied in that state.

- Total Sales Tax: The exact dollar amount of the tax.

- Car Price After Tax: The total car price including tax.

Detailed Information about the Car Sales Tax Calculator

Our tool supports all 50 US states and provides accurate tax calculations based on the most recent tax rates.

- Supported States: All 50 US states, including Alaska, California, Texas, Florida, New York, and more.

- Type of Vehicles: This calculator is suitable for both new and used cars.

- Tax Updates: We keep the tax rates up to date to reflect any changes made at the state level.

- Hidden Fees: The calculator shows only the net car price after tax, other fees may apply.

Example Calculation

Suppose you're purchasing a new car for $25,000 in California, where the sales tax rate is 7.25%. Here’s how you can calculate:

- Car Price Before Tax: $25,000

- Sales Tax Rate: 7.25%

- Sales Tax Amount: $1,812.50

- Total Price After Tax: $26,812.50

The calculator instantly provides this breakdown for you.

Reason to Use Car Sales Tax Calculator

- Accuracy: Our tool is updated with the latest tax rates.

- Time-saving: Get an instant estimate without complex formulas.

- Simplicity: User-friendly design that anyone can use.

- Comprehensive: Supports all 50 US states and works for both new and used cars.

Step-by-Step Instructions for Car Sales Tax Calculation

- Open the Calculator: Visit the Car Sales Tax Calculator on our homepage.

- Select Your State: Choose the state from the dropdown list where you will purchase the car.

- Input Car Price: Enter the pre-tax price of the car.

- Press ‘Calculate’: Click the ‘Calculate’ button to get your tax estimate.

Review the Results: View the total tax and the final car price after tax.

Formula Used for Calculation

Sales Tax:

Sales Tax = (State Sales Tax Percentage / 100) x Car Price (Before Tax)

Total Price After Tax:

Total Price After Tax = Car Price (Before Tax) + Sales Tax

Step-by-Step Example Calculation

Scenario:

You are buying a new car priced at $30,000 in California, where the state sales tax rate is 7.25%.

Steps:

- Enter the Pre-Tax Car Price: The pre-tax price of the car is $30,000.

- Select the State: Choose California from the dropdown.

- Apply the Formula:

Using the formula:

Sales Tax = (7.25 / 100) x 30,000 = 2,175

So, the sales tax for this vehicle in California would be $2,175.

- Calculate the Total Price After Tax:

Total Price After Tax = 30,000 + 2,175 = 32,175

Therefore, the total price after tax is $32,175.

Detailed Example of Multiple States

Let's compare how the sales tax would vary for the same car ($30,000) in different states:

| State | Sales Tax Rate | Sales Tax | Total Price After Tax |

|---|---|---|---|

| California | 7.25% | $2,175 | $32,175 |

| Texas | 6.25% | $1,875 | $31,875 |

| Florida | 6.00% | $1,800 | $31,800 |

| New York | 4.00% | $1,200 | $31,200 |

| Arizona | 5.60% | $1,680 | $31,680 |

Additional Factors

- Local Taxes: Additional local taxes may apply based on the city or county.

- Exemptions or Discounts: Some states offer exemptions for certain groups or vehicle types.

- Trade-In Value: The trade-in value can sometimes be deducted from the car price before calculating sales tax.

Car Sales Taxes in the USA by State

| State | Range of Sales Tax Rate |

|---|---|

| Alabama | 2.00% to 4.00% |

| Alaska | No state sales tax, but local municipalities may have sales taxes |

| Arizona | 5.60% to 10.725% |

| Arkansas | 6.50% |

| California | 7.25% to 10.50% |

| Colorado | 2.90% to 11.20% |

| Connecticut | 6.35% |

| Delaware | No sales tax |

| Florida | 6.00% to 7.50% |

| Georgia | 4.00% to 8.90% |

| Hawaii | 4.00% |

| Idaho | 6.00% to 8.50% |

| Illinois | 6.25% |

| Indiana | 7.00% |

| Iowa | 5.00% to 7.00% |

| Kansas | 6.50% |

| Kentucky | 6.00% |

| Louisiana | 5.00% |

| Maine | 5.50% |

| Maryland | 6.00% |

| Massachusetts | 6.25% |

| Michigan | 6.00% |

| Minnesota | 6.50% to 8.875% |

| Mississippi | 5.00% to 7.00% |

| Missouri | 4.225% |

| Montana | No sales tax |

| Nebraska | 5.50% |

| Nevada | 6.85% |

| New Hampshire | No sales tax |

| New Jersey | 6.625% |

| New Mexico | 5.125% to 9.0625% |

| New York | 4.00% to 8.875% |

| North Carolina | 3.00% to 7.50% |

| North Dakota | 5.00% |

| Ohio | 5.75% |

| Oklahoma | 3.25% to 11.50% |

| Oregon | No sales tax |

| Pennsylvania | 6.00% |

| Rhode Island | 7.00% |

| South Carolina | 5.00% to 9.00% |

| South Dakota | 4.50% |

| Tennessee | 7.00% |

| Texas | 6.25% to 8.25% |

| Utah | 4.70% to 8.35% |

| Vermont | 6.00% |

| Virginia | 4.30% |

| Washington | 6.50% |

| West Virginia | 6.00% |

| Wisconsin | 5.00% to 5.50% |

| Wyoming | 4.00% |

Note: Rates may change, and additional local taxes applied may depend on the location of the car purchase.

Car Sales Tax Rate High to Low in the USA by State

Nevada, Kansas, California, Illinois, and Indiana are the top five states with the highest tax rates.

Nevada car sales tax rate in the USA

8.25%

Kansas car sales tax rate in the USA

7.50%

California car sales tax rate in the USA

7.25%

Illinois car sales tax rate in the USA

7.25%

Indiana car sales tax rate in the USA

7.00%

Rhode Island car sales tax rate in the USA

7.00%

Tennessee car sales tax rate in the USA

7.00%

Utah car sales tax rate in the USA

6.85%

New Jersey car sales tax rate in the USA

6.63%

Georgia car sales tax rate in the USA

6.60%

Arkansas car sales tax rate in the USA

6.50%

Minnesota car sales tax rate in the USA

6.50%

Washington car sales tax rate in the USA

6.50%

Connecticut car sales tax rate in the USA

6.35%

Massachusetts car sales tax rate in the USA

6.25%

Texas car sales tax rate in the USA

6.25%

Florida car sales tax rate in the USA

6.00%

Idaho car sales tax rate in the USA

6.00%

Kentucky car sales tax rate in the USA

6.00%

Maryland car sales tax rate in the USA

6.00%

Michigan car sales tax rate in the USA

6.00%

Pennsylvania car sales tax rate in the USA

6.00%

Vermont car sales tax rate in the USA

6.00%

West Virginia car sales tax rate in the USA

6.00%

Wyoming car sales tax rate in the USA

6.00%

Ohio car sales tax rate in the USA

5.75%

Arizona car sales tax rate in the USA

5.60%

Maine car sales tax rate in the USA

5.50%

Nebraska car sales tax rate in the USA

5.50%

Iowa car sales tax rate in the USA

5.00%

Mississippi car sales tax rate in the USA

5.00%

North Dakota car sales tax rate in the USA

5.00%

South Carolina car sales tax rate in the USA

5.00%

Wisconsin car sales tax rate in the USA

5.00%

Louisiana car sales tax rate in the USA

4.45%

Missouri car sales tax rate in the USA

4.23%

Virginia car sales tax rate in the USA

4.15%

Hawaii car sales tax rate in the USA

4.00%

New Mexico car sales tax rate in the USA

4.00%

New York car sales tax rate in the USA

4.00%

South Dakota car sales tax rate in the USA

4.00%

Oklahoma car sales tax rate in the USA

3.25%

North Carolina car sales tax rate in the USA

3.00%

Colorado car sales tax rate in the USA

2.90%

Alabama car sales tax rate in the USA

2.00%

Alaska car sales tax rate in the USA

0.00%

Delaware car sales tax rate in the USA

0.00%

Montana car sales tax rate in the USA

0.00%

New Hampshire car sales tax rate in the USA

0.00%

Oregon car sales tax rate in the USA

0.00%

Frequently Asked Questions (FAQs):

What is car sales tax?

Car sales tax is a tax imposed by the state on the purchase price of a new or used vehicle.

How do I calculate car sales tax?

Enter your state and the pre-tax price of the car into the calculator to see the tax instantly.

Are car sales taxes the same in all states?

No, car sales tax varies by state. Some states also impose additional local taxes.

Do I have to pay sales tax on a used car?

Yes, in most states, both new and used cars are subject to sales tax.

Can I avoid paying sales tax on a car?

Certain states or exemptions may allow you to avoid paying full sales tax, but in most cases, it's mandatory.

How often do sales tax rates change?

Sales tax rates can change yearly or even more frequently depending on state laws.

Can I use the calculator for commercial vehicles?

Yes, the calculator works for personal and commercial vehicle purchases.

What if I buy a car in another state?

You may have to pay sales tax in your home state when registering the vehicle.

What is the highest sales tax rate in the US?

Nevada has one of the highest sales tax rates, at 8.25%.

Do all states have a car sales tax?

No, some states like Delaware and New Hampshire do not have a sales tax on cars.

Is sales tax the same for electric vehicles?

Some states offer reduced tax rates or exemptions for electric vehicles.

How do I know if the sales tax rate has changed?

Our calculator is updated regularly with the latest tax rates for each state.

What if I overpay on sales tax?

You may be eligible for a refund if you overpay sales tax, depending on state policies.

What is the car tax rate in California?

California's car tax rate is 7.25%.

References:

- Brennan, R. (2024, February 7). Auto tax rates by state (2024). https://www.policygenius.com/auto-insurance/auto-tax-rate-by-state/

- Cudd, G., & Cudd, G. (2024, August 28). What's the Car Sales Tax in Each State? (Updated for 2024). Find the Best Car Price. https://www.findthebestcarprice.com/car-sales-tax-by-state/#States_with_No_Sales_Tax

- Dehan, A. J. (2024, March 31). Can I legally avoid paying taxes on a used car? https://finance.yahoo.com/news/legal-way-avoid-paying-sales-130033476.html

- New and Used Car Sales Tax Costs Examined - CarsDirect. (n.d.). https://www.carsdirect.com/car-pricing/breaking-down-car-sales-tax-cost

- Sales tax and use tax rate on motor vehicles | Washington Department of Revenue. (n.d.). https://dor.wa.gov/education/industry-guides/auto-dealers/sales-tax-and-use-tax-rate-motor-vehicles